Construction Pricing’s 12-Month Trajectory

The 12-month period from May 2021 to April 2022 saw some of the highest increases in construction pricing since the 1970s. Our internal data indicates that in the DC metro area, average monthly increases in bid prices are approximately 1%, for an annual increase of over 12%. The impact varies across project types and market sectors. Labor-intensive activities such as demolition and renovation work have not been impacted as much as material-intensive projects such as new construction or prefabricated buildings. Engineering News Record (ENR) reports their Building Cost Index for 2021 increasing by 13.1%, as a national average.

The traditional relationship of supply and demand still applies. The surge following two years of restricted market activity has contributed significantly to the demand side of the equation. On the supply side, the well-documented supply chain disruptions, now exacerbated by increased oil and transportation costs, have been a potent combination. Most forecasters have been caught off guard by how long inflation has stayed at elevated levels. Even with the recent interest rate increases, it appears that inflation will remain well above historical levels through 2022. There is also a suspicion of a “bandwagon effect” in many industries, with suppliers recognizing an opportunity to recoup losses incurred during the pandemic by increasing prices. Some are taking advantage of the situation well beyond the existing raw material or delivery challenges, examples being the price of PVC pipe doubling in 12 months or wall framing costs increasing by 80%.

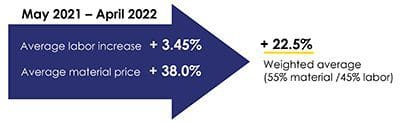

Axias regularly surveys the components of construction costs in many areas of the United States. This includes input costs such as labor rates, material costs, and equipment pricing. We also track the more market-driven output costs, profit margins, and similar indirect costs, which determine bid levels. One recently completed nationwide survey indicated the following general conclusions on input costs:

The primary contributors with the highest material increases have been copper products such as wire, steel-based finished products like steel pipe, door frames, EMT conduit, and wall framing; and plastic-based products such as PVC pipe. With the cyclical nature of commodity pricing, some materials can reduce year-over-year, but that did not happen in the last 12 months, which was unusual. Labor shortages are well-documented, but this hasn’t demonstrably impacted wage levels thus far.

With bid prices only increasing by 12% in the DC metro area, it is clear some costs are being absorbed or negotiated out by sub-contractors, whereas others are being recovered through contract changes and claims. Because this is largely unsustainable, bid prices will continue to rise over the course of the year but then likely begin to level off and slowly decrease as a result.

Forecast for 2023 – 2024

Chief Economist Simon Baptist of the Economist Intelligence Unit in mid-June stated that:

“In quarter-on-quarter terms, US consumer price inflation should fall below 1% by the fourth quarter and continue to drift further downwards throughout 2023. Year-on-year inflation measures will also cool but remain elevated until the second quarter of 2023, when the dramatic commodity price shifts following Russia’s invasion of Ukraine fall out of the base of comparison. Although the inflation rate will drop, we don’t expect to see deflation, and commodity prices will merely stop increasing rather than giving up their gains of the first half of this year. Even as commodity prices drop back, there will be continued cost pass-through at subsequent levels of the supply chain as producers and retailers adjust prices to reflect this new, higher medium-term level of commodity prices.”

At Axias, we review multiple data sources to inform our escalation and inflation calculations. Still, the above most closely aligns with how we see the construction market over the next 18 months: a cooling off towards the end of this year to an annualized rate of 8.5%, continuing to drop in 2023 to 6% for the year, and in 2024 reverting closer to historical averages but remaining elevated at 4.5%.