The Double Squeeze: How Tariffs and Labor Challenges Are Driving Up Construction Costs

The Trump Administration has issued several Executive Orders ordering tariffs (taxes) on certain imported materials, several of which are used in construction. The most impactful are on steel and aluminum, used in many components typically found in commercial construction, ranging from rebar, structural steel members, wall framing, and metal decking to windows, metal finish panels, stairs, EMT conduit, and ductwork. Tariffs on energy, such as the 10% applied to Canadian oil and gas, can permeate across all materials, as freight costs could increase, in addition to products derived from the oil refining process. The across-the-board 25% on all imports from Canada and Mexico, 20% from China, and various levels on EU exports will impact flooring, appliances, light fixtures, computers, cast iron products, furniture, and many others.

In addition to this headwind for construction, the seemingly persistent labor shortages in construction will intensify as the new administration’s focus on immigrant labor, both undocumented (less impactful in construction) and those on temporary protected status, which could impact thousands of construction workers across the country. These workers can be found in crews of drywallers, painters, tilers, and carpenters, while many have gone through full apprenticeships and become electricians, data technicians, plumbers, and pipefitters.

The Impact of Tariffs on Material Costs in Construction

The tariffs currently in place (as of March 19th) that impact construction are as follows:

These tariffs are already having an impact on subcontractor material prices for use in construction – per the Associated Builders and Contractors:

“Nonresidential input prices increased at a rapid pace in February and have risen at a far-too-hot 9.0% annualized rate through the first two months of 2025,” said ABC Chief Economist Anirban Basu. “Iron and steel prices rose at a particularly fast rate in February, a result of tariffs providing domestic producers with increased pricing power.”

Iron and steel prices rose 3.69% from January to February. Looking back on what happened during the previous Trump administration, similar tariffs, including a 25% tariff on steel and a 10% tariff on aluminum imports, were implemented in 2018. This history provides insight into the current impact, as captured in a recent article from Reuters.

“Both aluminum and steel prices had been increasing in the first years of the first Trump administration, but the anticipation and sub-sequent imposition of the tariffs on these metals caused their domestic prices to pop up more dramatically. U.S. steel prices rose 5% in the month after tariffs first went into effect and aluminum rose 10%.

However, after a few months, U.S. aluminum prices began to fall, soon followed by the price of domestic steel. But the gap between U.S. and worldwide prices for both remained wider than it had been pre-tariffs. The prices also decreased more slowly than they had risen, especially for steel, which had been tariffed at the higher 25% rate. U.S. steel did not return to its pre-tariff price until January 2019.²

The increases felt in that period are being repeated, at least in the short term. The Bureau of Labor Statistics reports that Iron and Steel commodity prices increased by 3.9% in February and steel mill products by 2.7% in just one month. These increases have not yet fed into products derived from iron and steel, which will presumably show similar month-over-month increases consistent with these input cost changes.

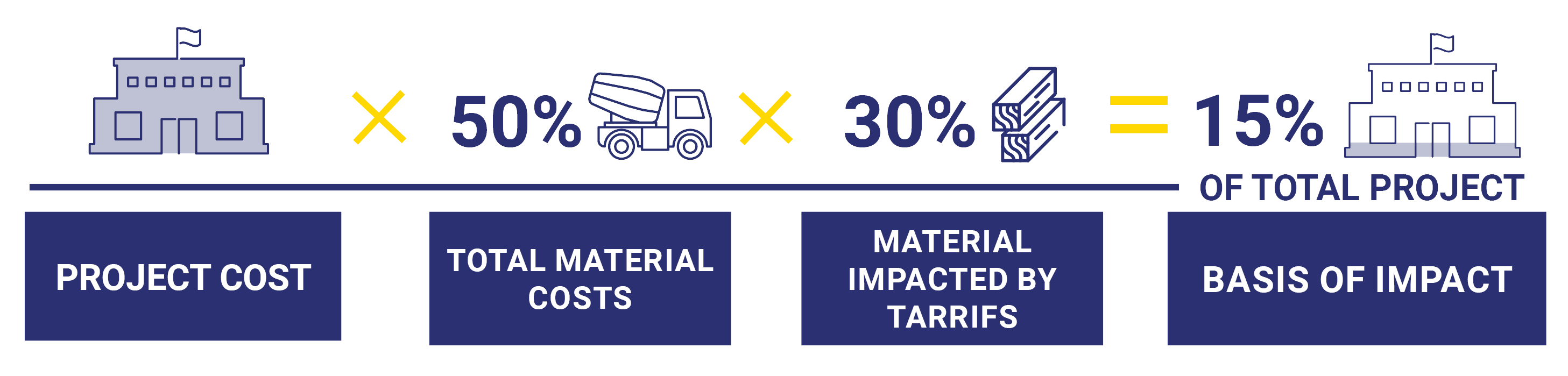

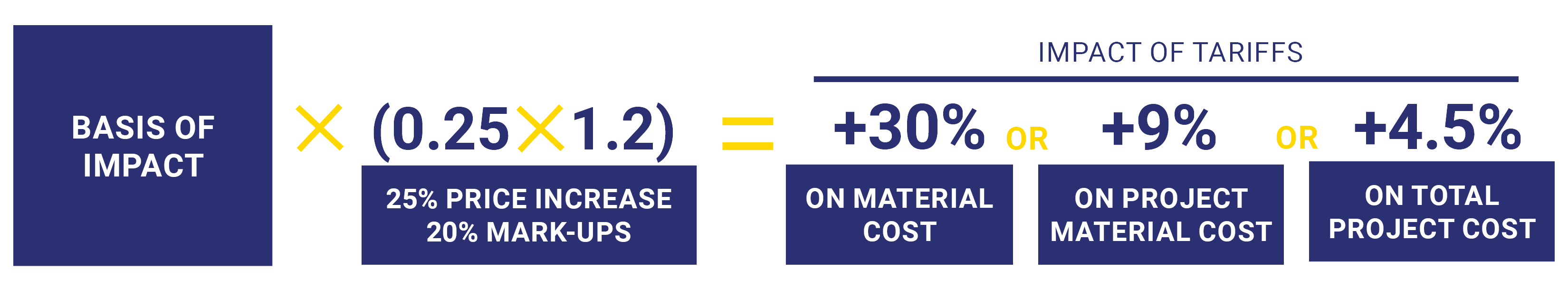

What does this mean for construction costs? While it’s important not to overreact to short-term market gyrations, as cost advisers we need to be aware of price movements and how they are passed on to owners. How are Axias’ professionals quantifying the potential impact of these changes? For projects starting construction in 2025, we analyze the effects as follows:

Applying the methodology above on a $22 million project the impact of tariffs would be about a price increase of about $1 million. Knowing what we know about the potential impact of tariffs today, we recommend adding between 4 – 8% to the estimated project cost as a tariff allowance. We suggest a range as the effects will vary by project depending on the material share of the cost and types of materials included. The impact may, of course, change as tariffs are modified, removed, added, etc.

Labor Challenges

The construction industry was already experiencing labor challenges in finding enough workers to fill the available positions in construction before the Trump administration issued 10 executive orders regarding immigration and initiated mass deportations last month. However, through our regular surveying of unions and assessing labor availability, the labor picture is not as dire as some reports indicate. At the same time, there are pockets of the country where demand is outstripping supply. Data suggests that the share of immigrant workers in the construction industry hit a record high last year, and these executive orders could reduce that labor pool significantly, which is not ideal for the construction industry.

This reduction in supply can, of course, only lead to one outcome, assuming demand stays constant or increases. Wages will need to increase to attract workers, which will then flow through to owners in the form of higher construction costs. Additionally, a lack of available workers may extend project schedules, leading to higher general conditions costs from extended durations. The challenge is not so much finding workers, it’s paying them enough to attract them from competitors or from other industries through training programs, while still staying competitive in what is a very price-sensitive industry.

From The Economist:

“Demand for labor can run above supply, such as after the covid-19 pandemic, when high spending boosted demand for labor. In such circumstances, wages rise as firms compete for staff.

When you dig into the data, evidence of shortages often melts away. Consider construction, a classic “shortage occupation” in many places. America’s homebuilders’ trade group talks of a “dire need” for new workers. In reality, over the past decade, the share of the American workforce involved in construction has risen from 4.5% to 5.2%, which does not scream “shortage”. Maybe the “true” share of construction workers in America should be even higher. But this is hard to square with the data on wages. In the past decade, earnings growth in American construction has been slower than the overall average.” ³

However, given the likely reduction in the pool of available workers as a result of the immigration actions outlined above, wages will likely increase at a higher annual rate than in past years (the past average is 3.8 – 4.2%). We forecast construction worker wages will increase by at least 5% in 2025 and possibly higher in 2026. Unlike the impact of tariffs, this is not an allowance/premium to be added to a cost estimate for a short-term situation; it’s an input cost to be built into unit prices now, and to factor into future escalation calculations.

Strategies For Coping with These Headwinds

Designing to budget is always good practice and often contractually mandated, but it is essential when external factors such as those described above are placing additional costs on the project.

Key strategies include:

¹ “News Releases | ABC: Construction Materials Prices Increase 0.6%, Steel Surges Nearly 4% in February.” Abc.org, 13 Mar. 2025, www.abc.org/News-Media/News-Releases/abc-construction-materials-prices-increase-06-steel-surges-nearly-4-in-february. Accessed 19 Mar. 2025.

² Sachdev, Vineet, and Anurag Rao. “What Happened the Last Time Trump Imposed Tariffs on Steel and Aluminum.” Reuters, 11 Mar. 2025, www.reuters.com/graphics/TRUMP-TARIFFS/STEEL/gdpznwgdzpw/.

³ The Economist. “Why “Labour Shortages” Don’t Really Exist.” The Economist, 13 Mar. 2025, www.economist.com/finance-and-economics/2025/03/13/why-labour-shortages-dont-really-exist.