Building replacement values may not be at the forefront of our thoughts daily, but they are an important part of financial strategies, risk management, and property decision-making. These values, known by various names like Current Replacement Value (CRV) or Plant Replacement Value (PRV), hold significant importance across diverse sectors. In industries such as manufacturing, Replacement Asset Valuation (RAV) calculations form an integral part of proactive maintenance initiatives.

By any name, replacement values are a vital tool for building owners and operators. Axias is witnessing a surge in client requests for precise estimates, be it individual buildings, historic segments of a larger building, institution-scale portfolios, and entire government installations or campuses.

For example, Axias is collaborating with a New York-based family-owned real estate enterprise providing replacement value cost estimates to bolster their risk management and insurance valuations. Many building owners find themselves underinsured due to outdated asset valuations that fail to keep pace with escalating construction costs, evolving building technologies, and current code compliance. Recognizing this gap, clients seek Axias' expertise in cost estimation, especially when standard valuation sources prove inadequate, resulting in understated replacement values.

Axias is also currently assisting a large institutional client in Washington DC establish accurate replacement values to fortify their maintenance budgeting. Industry guidelines suggest that sustaining an asset’s optimal performance typically requires an annual investment between 1 – 2% of its replacement value. This insight empowers agencies and facility groups to advocate for higher maintenance budgets. Consider a portfolio valued at $100 million; setting aside between $1 and $2 million annually for maintenance becomes imperative, but with updated replacement values that $100 million portfolio is actually valued at $175 million, allowing the owner to justifying an increase in appropriations for annual building maintenance.

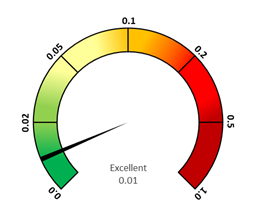

Accurately assessing building replacement values as well as capital repair and replacement projects is a key part of Axias’ facility condition assessment services. When evaluating expansive portfolios like college campuses, clients seek comparisons to prioritize renovations, capital projects, and potentially demolition/rebuild decisions. Employing a Facility Condition Index (FCI) proves effective, calculated by dividing the total deferred maintenance value by the CRV, offering a clear rating from very poor to excellent.

Current FCI

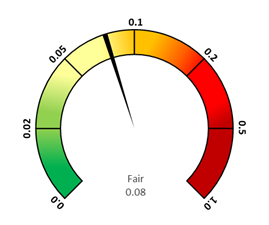

Future FCI

We are also able to calculate five- and ten-year Facility Condition Needs Indices (FCNI), projecting building conditions if deferred maintenance and necessary capital renewals remain unattended. This helps owners gauge potential deterioration in the absence of adequate budgets. These figures also highlight the impact of undervalued replacement values; the ratio of required capital needs to building replacement value should be an apples to apples comparison, but if the CRV is not in line with current pricing, the reflected ratio is not accurate. Our team strongly advocates updating building replacement values as part of the condition assessment process.

Whether it's portfolio valuation for insurance, maintenance budget planning, or condition assessment programs, having accurate building replacement values is pivotal in asset management for financial planning and risk management. Axias' expertise is frequently enlisted to support these efforts.